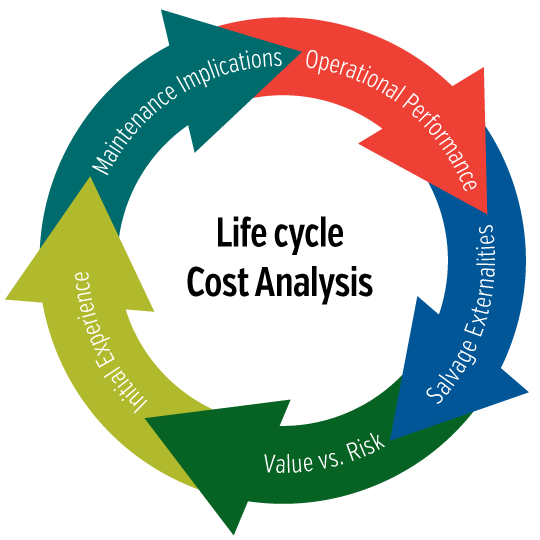

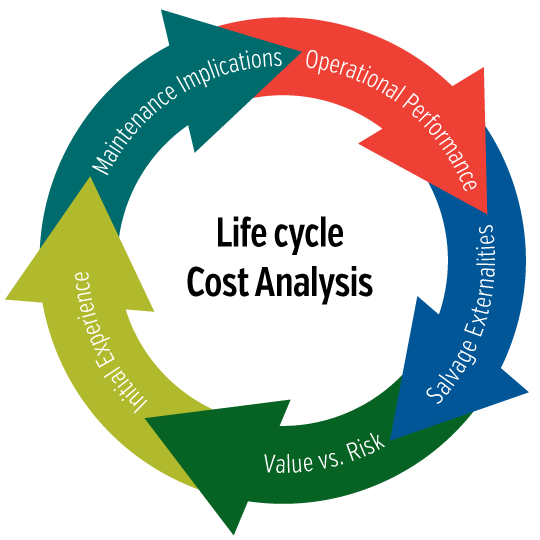

This course covering the use of Life-Cycle Cost (LCC) analyses to communicate solutions to management and members of the financial community. LCC evaluates many alternatives to identify the alternative with the least total cost of ownership. Evaluations are based on the entire cost of ownership including design, procurement, installation, maintenance, repair, and disposal costs. LCC analyses are based on the concept of Net Present Value (NPV) and can be discrete or probabilistic in nature. Participants will learn how to put reliability engineering skills into financial accounting terms. Each attendee will also learn techniques to perform real-world studies to evaluate the sensitivity of assumptions and uncertainties in the LCC model.

By the end of this course delegates will be able to:

Plant, equipment and reliability engineers, supervisors, and managers with little or no previous financial experience

Introduction to the Basics of Finance in Reliability

How to Do Life Cycle Costing

Introduction to Time Value of Money (TVM)

Time Value Analysis and Life Cycle Decision Making

Plant Equipment Project Analysis

Driving Improvement with Life Cycle Cost

CDGA attendance certificate will be issued to all attendees completing minimum of 80% of the total course duration.

| Code | Date | Venue | Fees | Register |

|---|---|---|---|---|

| MI147-02 | 03-05-2026 | Amman | USD 5450 | |

| MI147-03 | 10-08-2026 | Indonesia | USD 5950 | |

| MI147-04 | 29-11-2026 | Dubai | USD 5450 |

Providing services with a high quality that are satisfying the requirements

Appling the specifications and legalizations to ensure the quality of service.

Best utilization of resources for continually improving the business activities.

CDGA keen to selects highly technical instructors based on professional field experience

Since CDGA was established, it considered a training partner for world class oil & gas institution

3012, Block 3, 30 Euro Business Park, Little Island, Co. Cork, T45 V220, Ireland

Mon to Fri 09:00 AM to 06:00 PM

Contact Us anytime!

Request Info